Cevheri Güven

The sale of $128 billion in central bank reserves during Berat Albayrak’s time as minister of treasury and finance has become a major topic of controversy in Turkey. While Albayrak, who at the same time is President Recep Tayyip Erdoğan’s son-in-law, ultimately stepped down as minister, the issue has not disappeared and became a source of widespread debate with a development that took place on Tuesday.

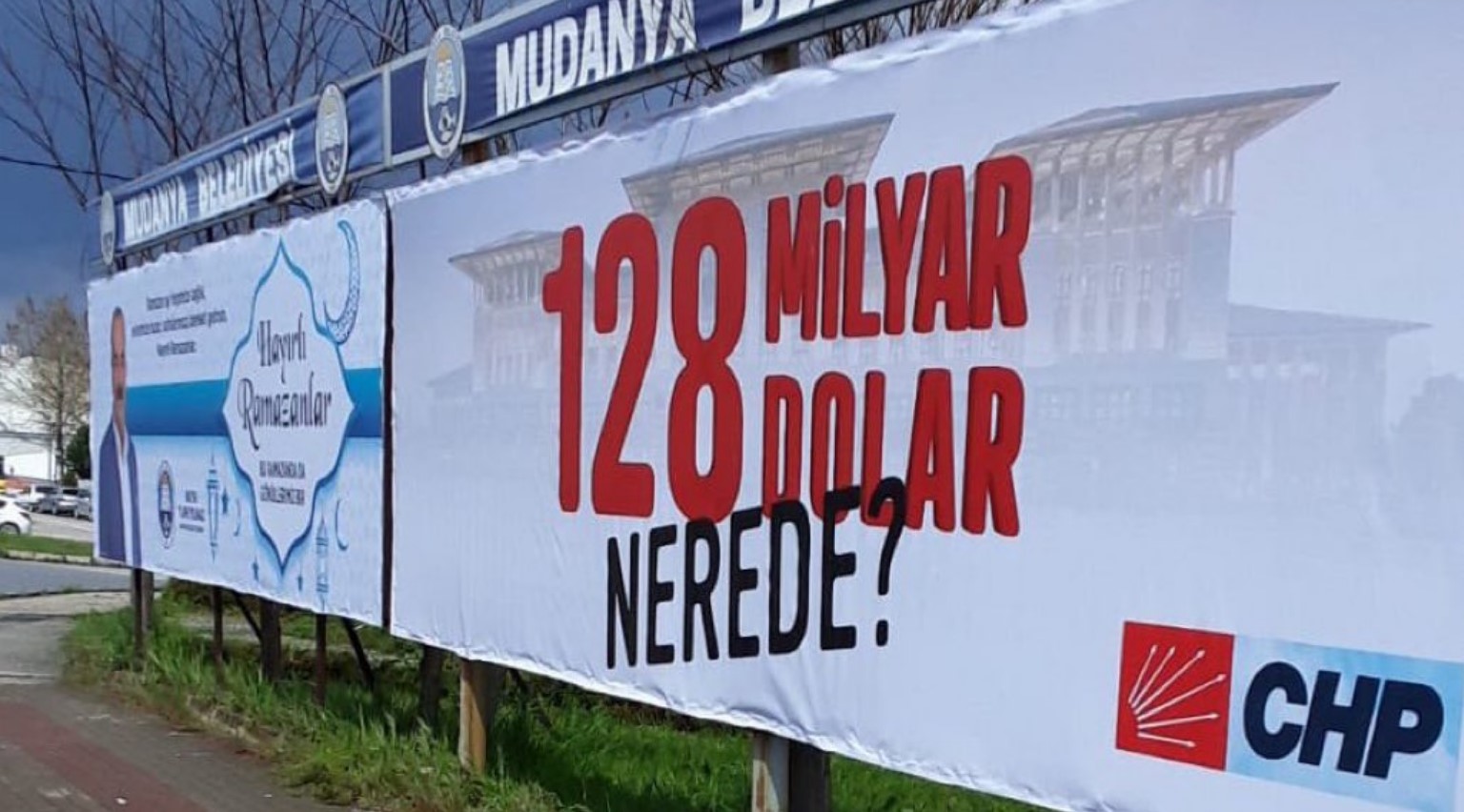

Kemal Kılıçdaroğlu, leader of the main opposition Republican People’s Party (CHP), held a parliamentary group meeting with a banner that asked “Where’s the $128 billion?” The party’s provincial networks hung the same banner on their headquarters. When the campaign made headlines amid the country’s ongoing financial turmoil, Erdoğan reacted in his typical way and called in the police. Cranes removed the banners from the buildings, accompanied by heavily armed special operations police.

For a while the opposition has been claiming that the $128 billion in central bank reserves was sold to an unknown buyer. The erosion in forex reserves took place during Albayrak’s leadership of the economy, which has extended the debate to implicate Erdoğan’s family.

Some have even claimed that Naci Ağbal, who was brought in as governor of the central bank following Albayrak’s resignation, was fired shortly afterwards because he was going after the same issue. Ali Babacan, leader of the DEVA Party, said an examination that Ağbal launched into the sale of foreign currency led to his removal from the central bank.

Albayrak’s policy of reining in exchange rates

During his time in office Albayrak implemented a policy of selling forex from central bank reserves in an attempt to stop the turbulence of the lira. Yet the buyers of the $128 billion remain unknown. Some in the opposition have claimed that it was banks, companies and individuals close to the government. However, the government has refrained from giving out a clear answer on the subject.

According to data released last week, the central bank’s forex reserves have declined to $10.7 billion, the lowest point seen since 2003. Taking into account prospective swap operations, Turkey’s reserves are estimated at a negative $40 billion.

Babacan, who was the economy chief in the early years of Erdoğan’s rule and who recently parted ways with Erdoğan to establish his breakaway political party, is one of the figures who frequently bring up the erosion of forex reserves. He claims that the sale was carried out in secret, in contravention of free market principles.

Potato lines

In response to the worsening economy, which has negatively impacted the purchasing power of citizens, the government has engaged in a series of PR moves. One of them was the allegation that food prices were deliberately driven up as part of a foreign-led conspiracy. Last weekend, hundreds of trucks loaded with potatoes and onions reached İstanbul, the country’s largest city, where the governor’s office ceremonially distributed tons of them to the public for free.

In a development that blindsided the government, the public rush to the free produce boosted the popularity of the “Where’s the $128 billion?” campaign. In response, prosecutors stepped in and banned the banners and billboards erected by the CHP across the country.

The government finally addresses the question

After growing public reaction, the government finally made a statement on the issue it had been ignoring.

Nurettin Canikli, deputy chairman of the ruling Justice and Development Party (AKP), said the sale of $128 billion in forex reserves was entirely on the record, registered in detail.

Economist Mahfi Eğilmez, in a blog article he published in October, had said central bank reserves were at a negative $39.6 billion in September, considering the swaps. In a chart Eğilmez drafted based on central bank data, the net reserves were at $20.6 billion in September 2019.

Eğilmez’s estimation was found optimistic by some observers. According to Tim Ash, a senior emerging markets sovereign strategist at the London-based BlueBay Asset Management, Turkey’s net reserves have dropped to negative $50 billion.

Economist Uğur Gürses in his personal blog wrote that some $12 billion the government compelled public banks to sell should also be kept in consideration. With this addition, Gürses says the loss is at $140 billion.

Gürses underlines that the billions that were sold did not evaporate and that the important thing is the identity of the buyers, the way in which the transaction was conducted and the rate at which the reserves were sold.

Same question everywhere

The opposition’s question “Where’s the $128 billion?” triggered an interesting means of protesting on social media with a number of users writing it on banknotes, walls, letters and stones and sharing pictures of them.