The Turkish lira hit a record low of 10.63 to the US dollar with the expectation of an interest rate reduction after President Recep Tayyip Erdoğan said his fight against high interest rates would continue.

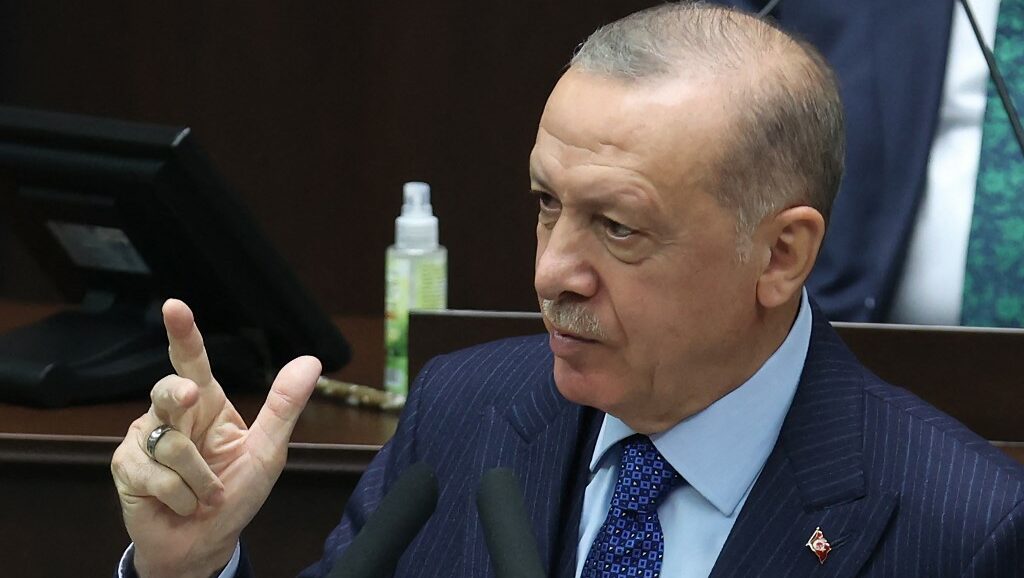

Erdoğan’s remarks came at a meeting of his ruling Justice and Development Party (AKP) on Wednesday at a time when the Turkish lira suffered one of its biggest falls of the year this week and hit new historic lows to cement its status as the year’s worst-performing emerging market currency.

“We will rid this nation of the interest rate calamity. We will never let interest rates inflict suffering on our nation. … As long as I hold this position, I will continue my fight against interest rates and inflation,” Erdoğan said. He is widely criticized for subscribing to the unorthodox belief that high interest rates cause high inflation instead of slowing it down.

The president noted that some members of his party defend high interest rates, adding, “I can’t be on the same path as them.”

Erdoğan’s remarks led to claims that the country’s central bank would further reduce interest rates at its meeting on Thursday, leading the Turkish lira to lose even more value against the US dollar.

In February Erdoğan replaced a market-friendly central bank governor who raised rates sharply during his four-month term with party loyalist Şahap Kavcıoğlu.

Turkey’s nominally independent bank has bowed to incessant pressure from Erdoğan to lower the cost of doing business in order to stimulate growth.

This push has put Turkey’s economy on course to expand by roughly 10 percent this year.

But it has also seen the annual inflation rate reach almost 20 percent and the lira lose more than a quarter of its value against the dollar this year.

The central bank lowered its policy rate from 18 percent to 16 percent in October.

This means that Turkey has a negative real interest rate — a policy that devalues lira assets and gives additional incentive for people to buy foreign currencies and gold.